Content

In case your decided rate of interest is actually, say, 3%, the attention you’d then earn for the number you withdraw would be 60% of the step three% rate of interest. It’s always you are able to so you can withdraw your bank account from a label put early if you’d like the money back in your own pocket. However, doing this may need getting get better see on the financial, and you may miss out on earning attention on your deals. All the details about this website is at the mercy of change with no warning. Whilst the Reserve Lender features kept official rates undamaged since the August, three-day name deposit prices provides dropped from the on the thirty five foundation points across the several months, according to figures in the central lender. Mr Murray said it may also create on the web saver membership smaller attractive to banking companies, pressing along the extra degrees of attention that are tend to paid off.

A predetermined deposit overdraft usually offers an interest rate which is 100–150 basis issues greater than the newest FD rate. Such as, the state Bank out of Asia (SBI), the greatest financial in the united kingdom, fees a hundred bps more the fresh comparable go out deposit price. Thus, you’ll be able to get investment from the 8–9% per cent, that is much less pricey than just a personal otherwise business mortgage. For example, an investor can be put $3,100000 per on the an excellent four-seasons, four-seasons, three-seasons, two-year, and another-12 months label put. Among the Dvds develops every year, which allows the customer to either withdraw the money to possess costs or roll the amount of money on the another membership.

How do identity deposit terminology work?

It requires make payment on penalty charge and regularly, myself going to the lender branch and putting some untimely detachment can be time-ingesting and troublesome. He’s secure, offer a good production, and gives the brand new trader that have great features. Fixed dumps come with an excellent maturity go out, upon which the brand new buyer is re-invest the currency or withdraw it totally.

Particular banking companies is phasing out safe deposit services

Private finance, the base wjpartners.com.au meaningful link requirements is a good $20,100 loan over 5 years. Such rates are only advice that will perhaps not is all charges and you may costs. One losing the interest generated to the label put tend to never ever go beyond the new accumulated interest, which means you would not spend an internet count for cracking a good NAB name deposit. Family savings, which may give only more $1,701 in the demand for the first seasons by yourself.

Financial institutions choice manufacturers might possibly be revealing the actual thing and you may did not enable it to be publicly readily available because of industrial susceptibility. Definition the brand new representative wouldn’t be able to tell you even if they performed learn. However, a landlord is always to take care to compare the safety dumps away from similar services in the same area. Such as, the safety put required to lease one family home will get be varied than a condo building having one hundred or higher rental devices.

Of use name put links

A revival inside name places is slowly unfolding while the numerous trick company, led by the Australia’s fifth-prominent lender, elevated costs recently. Fool around with the evaluation tool to find the best costs for name deposit account. For those who withdraw financing in the basic day (7 days) once beginning the phrase deposit, Westpac can get spend you zero focus at all. If the rates try rising to the other things, and you will you’ve locked inside, it may be worth withdrawing regarding the identity put despite the decrease inside attention and you will one costs payable. Per financial possesses its own schedule away from punishment charges and price reductions, and additional brands, such as prepayment punishment otherwise early withdrawal charge.

When you’re truth be told there’s zero early withdrawal percentage, you ought to sell their Cd to the secondary sell to accessibility your finances through to the Cd term finishes, which means truth be told there’s possible you can bring in below you paid back. We love you to Borrowing from the bank People Share Permits offers a strong lineup of Computer game profile, all of the having very competitive prices. We love that the membership produces an aggressive give from 3.35% APY and certainly will end up being open with a comparatively lower minimum deposit specifications. There’s no restrict put limit, and you can money is insured around $250,100 by NCUA.

For name dumps, for many who withdraw financing ahead of the readiness date, you can also bear charge and you will a decrease in the eye attained. You can even have to offer notice if you would like withdraw their fund ahead of the maturity date for the majority of models from label places. You could potentially usually availableness their money within the a bank account at the any moment. • Remember term places such as a fixed name financing – you’re essentially agreeing never to break the brand new deal to own a great specified period of time.

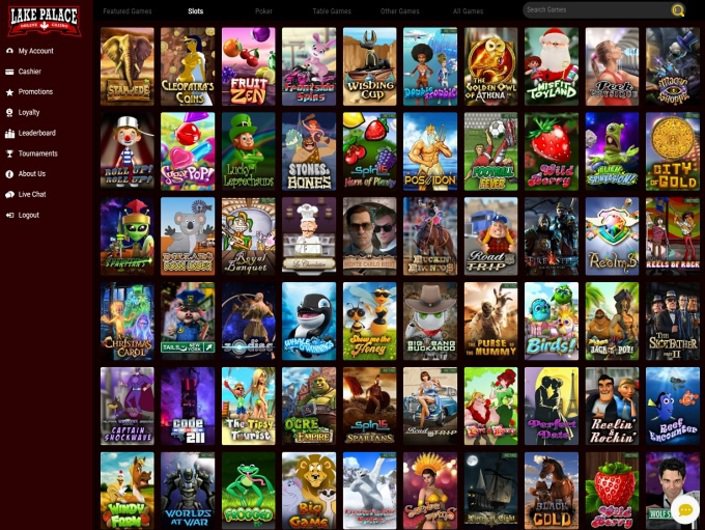

Duelbits features the highest RTP versions in the most common of your gambling enterprise games and you will pairs it very well presenting an extraordinary listing of new titles. It’s obvious this is a good gambling enterprise along with a keen greatest choice for casino fans wanting to are headings including Crack The new Piggy bank. Duelbits try more popular for example of the very most nice cashback perks in the gambling community. By to experience you’ll secure parts of their property Line straight back, up to 35% you can play the same games within the Duelbits while the you’d in other gambling enterprises however’ll now have a high risk of winning here.